How To Become A VC From Nothing -

Lessons From My Career - Engineer, Operator, and VC Fund Manager

Last week I reflected on my career. I’m thankful for so many people and opportunities I have received. I didn’t have a traditional path into venture. People often ask me how one gets into venture capital. I’m sharing my experience on how I became a VC from nothing.

Beginnings

I immigrated from a very large city Mumbai to a small town in upstate NY, Poughkeepsie. I didn’t know anyone there except for some extended family. To fund my way to college the advice given to me was to get employable skills for a job, so I taught myself to type & code. I found work at a computing lab at Marist, a local college (and also at a department store).

My work in the lab convinced Marist to accept me without SATs. This gave me the incentive to work hard and graduate early to save the cost of an extra year. I also had time to fit in piano and ballet! I graduated in the recession of 2002. Some professors (my clients at the computing lab) took interest in me & employed me at IBM.

Balancing work and college

Now at 19, I had a 40 hour job as an engineer while in college. I proved to be one of the best Quality Assurance (QA) testers and was one of the rare hires during that recession.

I rose up the ranks at IBM where managers & mentors recognized my efforts & hustle. They rewarded me with the platform to learn business communication, people, & writing skills. They sent me to many executive programs meant to groom ‘the rising stars’. As an immigrant getting this training was a dream.

I wanted to expand my tech skills while working, so I decided to go to Computer Science Grad School at Columbia with a focus on data & analytics. This was a golden opportunity to expand my network so I met everyone I could, including the Head of the CS dept who became my technical mentor and the co-founder of my startup Penseev, a social data platform.

Back at IBM I was working with some high profile teams & projects in the CEO office. You can find Harvard case studies on these groups. The relationships I built there still last to this day and I happen to connect with Amy Hermes from that team who recently invited me on a panel at AWSre:Invent. These friends, bosses, & mentors I had made over 10 years also helped me achieve my dreams of starting a company and going to business school by opening up their networks for me. I wouldn’t have gotten into ChicagoBooth without them.

Business School

At Booth I met my best friends and professors, many of which are Limited Partners (LPs) in my funds. I’m grateful for the faith shown to me considering they meet 800+ students a year and have seen excellent candidates over 25-30 years. The Chicago Booth Magazine also covered my career journey.

Venturing into venture

After my startup, I decided to reverse engineer Venture Capital. Why? The venture world did not have many investors of my profile which I saw as an opportunity rather than an obstacle. So I worked at a few funds during business school where I created a thesis on big opportunities in Big Data, SaaS, and Cloud. I shared my thesis with VCs along with some good potential investments.

One of my professors Steve Kaplan advised me to join Kauffman Fellows and through that network I ended up as one of the founding investors of the Samsung Next Fund. I was one of the only partners with many early exits to @Apple @SamsungUS @McGrawHillK12 where I was lucky to join startups boards & learn from other VCs.

In 2015 armed with operating & VC experience I launched Array Ventures. Many of my early investors were founders, bosses, professors who I had met over 15 years. Founders encouraged me to start Array because they liked working with a technical investor with engineering, operator, & VC experience.

The Array Ventures Fund

Array invests first checks in enterprise deeptech companies where we look to add value on Go-To-Market (GTM) which often means a good path to customers and customer development. During our investment process we meet the team, customers and figure out value add down the road. If we are serious but not ready to invest, we will still help via intros and customer diligence. Our focus is on value add even before the investment.

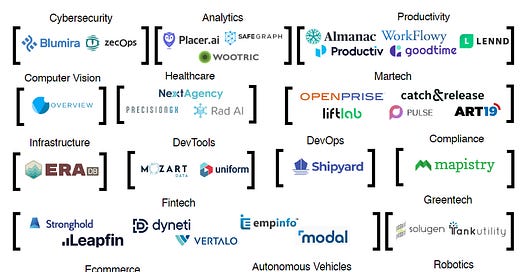

Now we are on our 2nd fund (3rd coming soon), 45 investments in companies like Productiv, MozartData, Openprise, Blumira, Placer.ai, CasaOne, EraDB, Safegraph, Catch&Release, Uniform, Almanac, Goodtime.io and many more!

We’ve had some good early exits as well with Simility acquired by Paypal (press release here), PassageAI acquired by Servicenow and Hivy / Managedbyq by We Work

We are just getting started! Any founders starting enterprise companies should reach out to us. If you want to invest in Array then there might be an opportunity there as well! I’ve had an exciting 2 decades across 3 different careers and can’t wait to build the next 15 years in venture!

My life lessons that actually have become principles I operate by -

Being grateful is not just an emotion it’s also action. Pay it forward by giving whatever you can without worrying about what you are getting back.

Do everything you can to immerse yourself in your task. If you make up your mind to achieve something give it your all, get skills and experience. Success doesn’t come overnight. For me, after 20 years I am still building my success!

Earn your luck. I'm always grateful to meet my mentors and colleagues who opened doors for me and gave me opportunities but I believe you need to work hard to earn that chance.

Check out the tweetstorm here. Also, follow me here to get future posts.

Thanks for sharing this Shruti. I am also now into venture, from nothing , or as I describe it , self taught "learning it by doing". I am a Chicago Boothie as well. That gives us the confidence that we can figure it out. The one thing I did learn is that very few, if any , "classic VCs" people open any doors for you. Once I understood that, I decide to move past it. I am a hungry , successful immigrant..I am opening my own doors into VC. It's been great so far.

Inspiring, thanks for sharing, Shruti