[Array VC] Exciting Reads, Investments, & Job Opportunities

New Investments, Exits, IPO, M&A, Valuations, Market Observations, & More...

2024 started with some great news for Array Ventures. We returned most of the Fund I to our LPs in 7 years. 🎉🎉🎉

Some notable companies in this fund: PlacerAI, RadAI, Solugen, Openprise Catch+Release, Zendar, and Vue.ai.Array Ventures (website) invests in enterprise data/AI companies in their first ever raise. We are still investing connect with us (arraydeals@array.vc) if you are know anyone starting an enterprise data/AI company and looking for a $1.5 - 2m check

Welcome New Investments to the Array Family in 2024

73rd Investment: Moksa AI is a video intelligence platform identifying theft, shoplifting, & employee efficiency.

74th Investment: AnswersAI is a 1-click answers to questions

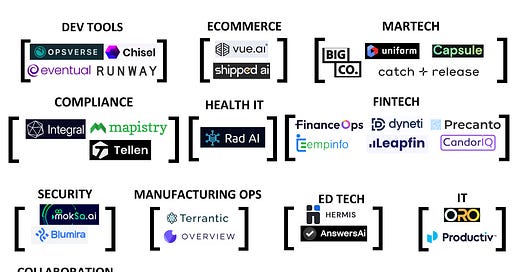

Investors, Job Seekers, Curious People: Here is a list of all our relevant companies

Portfolio Notable News & Follow-on Rounds:

Openprise (RevOps data automation) closed a Series B led by Morgan Stanley

RadAI announces partnership with Google and closes their Series B

Eventual Computing (data warehouse for unstructured data) launched DAFT which is seeing a lot of traction!

Happyrobot builds AI Voice Agents to automate phone calls in logistics

Tumble.to granted patent for distributed networked laundry machine control

Productiv adds Sidekick to help you manage your software licenses

L Catterton, a leading consumer investment firm, partners with LiftLab

CandorIQ offers Global Benchmarking Data across 100 countries, 5 million records & 380 roles

***Are you still investing? Are you an angel or seed investor interested in seeing deals then please fill out this form to get access to B2B data deals. ***

Job Opportunities At Array’s 60 Portfolio Companies

Our companies are hiring and looking for Engineers (leads and IC’s), Sales, Customer Success, Marketers, Designers and more globally including many remote openings. Check out all the listings here.

Market Observations From An Early Stage Startup Investor

2023 was a tumultuous year with Q4 being the roughest year in terms of fundraising for companies I have seen in my decade of venture career. VCs were tired from a rough year, unable to have a differentiated opinion and ready to check out. Customers wanted to push out all decisions to Q1, and many companies who have been barely surviving from multiple cuts needed money to keep the lights on but had already made all the cuts possible.

The quiet dying of startups will continue to happen in 2024. But many of those founders are coming back with new AI ideas, more enthusiasm, and even larger rounds. VC’s came back with a more renewed excitement with a reminder of why they got into the VC business. Customers are also in a similar boat and back to spending and purchasing. Public markets have also been showing strong performance and even crypto seems to be back!

In summary, the VCs are active again at all stages. Valuations in AI companies are still very high across all stages. The bet VCs are making is this is a once in a lifetime opportunity like the early days of the internet where new companies being built today will be the next Big Magnificent 7 company.

The deal flow has picked up again this quarter compared to Q4 last year. We are back in situations where rounds are oversubscribed with multiple term sheets. We are lucky founders are choosing to work with Array Ventures.

Appreciate you reading this far! We will now go back to looking at new deals, helping our portfolio companies, and doing other VC things!

Also, I try to send this newsletter once a quarter. For updates between newsletters follow me on Twitter and LinkedIn. Share this newsletter with your friends or reply with their email to add them to the distribution. Let me know if you find this valuable and any other things you would like to see!